Your estimate is buttoned up, the pitch went off without a hitch, the contract is signed…and now you’re in for the song and dance of chasing payment for the next few weeks. Sound familiar?

As a home improvement contractor, coordinating payment for large projects can be a headache. Collecting a deposit might be easy, but following up for remaining balances isn’t. It often involves coordinating visits to the home, or endless calls to either collect a check or process credit card payments over the phone. If you aren’t equipped with a way to accept credit cards easily, you’re in for it.

It’s a huge time-suck for small businesses. To be honest, contractors have better things to do than drive around trying to get their money. That’s why investing in contractor payment software that allows your team to accept credit card payments is crucial! We’re going over various payment processing options, what to consider when choosing a payment system, and ways to connect your payments to your CRM to save your time – and cash flow.

Payment Processing and Types of Payment Systems

So how do you evaluate a payment processing system and figure out what credit card processing for contractors looks like for your business? It’s helpful to understand how the system works and the types of payment tools available.

First, the payment system. This is how a business accepts payments. This encompasses all forms of payment methods, including cash, check, ACH payments, credit and debit cards.

The payment processor is the service by which money transfers between a buyer and a seller. These often come into play with credit card processing.

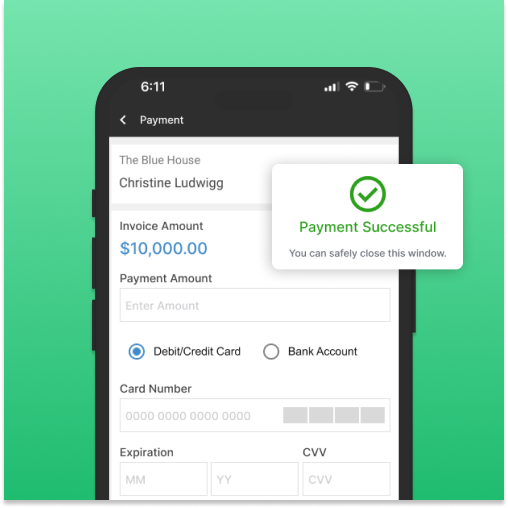

The payment gateway is where customers actually pay. If you stand at the register in a grocery store, the point-of-sale terminal is the gateway, either operated by a cashier or by self-serve. When a customer opts for online payment options, the gateway is the actual technology where that card information is collected.

Mobile Apps & POS Systems

To solve the headache of accepting credit cards in the home, many businesses might use a third-party payment mobile app like Paypal, Stripe, Square or Venmo. Some of these are a mobile-first transaction, and some of them can be made more robust for your business needs. For example, with Square, you can have a dedicated payment terminal and mobile card readers.

The pro of using one of these common mobile payment tools is that many customers are already familiar with them. However, a major con is that these may not be natively integrated with your accounting tools or CRM. You may have to do some double work to keep client records updated, and you may have to set up a few merchant accounts and pay processing fees for using these services.

The ideal solution is a payment system that integrates with your existing CRM, like LeapPay! With the direct integration between our payment processing system and Leap, you’re able to send invoices, track payments and collect money for each customer. It’s convenient, secure and makes managing your customer data easier than ever.

Choosing a Payment System

Now that you understand what a payment system does, and what some of the common tools to collect payments are, let’s talk about choosing the right payment system for your business!

There are some important things to think about when making your decision. What makes sense for your sales structure? How do you make the process as efficient and possible? What’s going to keep both your business and customers safe and secure?

Payment System Cost

You’ll need to evaluate the price-tag associated with your payment system. Most tools will require a subscription price, and payment processing fees for merchants. If you use a CRM that has a payment system included, you may pay an add-on fee to access the tool. Some payment systems, like LeapPay, are offered at no additional subscription fee to Leap users!

Comb the pricing structure of tools you’re evaluating to look for software fees, one-time fees, monthly charges, and fees per user. This will give you an accurate feel for how much that payment system will wind up costing you.

When evaluating, you’ll also want to look for flat rate credit card processing. This means that your chosen payment system will charge a fixed percentage on the transaction, and a fixed credit card processing fee.

This rate is important and varies from tool to tool. Many contractor platforms offer a rate as high as 3.95% +$0.30 on some types of credit cards, which means you’ll pay a larger percentage fee on credit card transactions.

In contrast, LeapPay has a 2.9% + $0.30 transaction fee on credit cards and debit cards, and .8% for ACH transfers.

Can I charge payment processing fees to customers?

The short answer is maybe. This depends on state regulations where you do business. Several states have made charging fees for accepting credit card payments illegal. That means you can’t charge the customer for credit card fees.

You can build the cost of payment processing into your pricing at the start to avoid the hassle!

Fraud Protection

There’s nothing more frustrating than being hit with fraud, and it can happen even if you’ve done everything right. From counterfeit checks to stolen credit cards, this is a risk of handling a payment system. However, you’ll be able to protect your business with good practices, and a secure payment gateway.

Banks are more likely to be liable for fraud when a card is physically presented, via swiping, inserting or tapping. Merchants are more likely to be liable when it occurs without a card, or the card information is keyed in.

You’ll want to invest in a payment processing tool that offers you fraud protection. be able to process in-person payments, such as when your sales team is at the table with a customer. A payment gateway also reduces fraud risk with address verification and CVV code verification for online payments. Many payment tools will build in security measures and fraud protection as well, so be sure to check the fine print!

A tool like LeapPay allows your sales reps to process in-person transactions by physically handling the presented card and verifying details like address and security code to reduce the risk of fraud. Plus, we employ advanced fraud protection measures to ensure the safety of your business transactions for online payments, too! Whether you’re collecting payments in person or via email, customer webpages or invoicing, you’ll be protected with LeapPay.

Contractor Payment Tips

Now that you’ve learned the nuts and bolts of payment processing and accepting credit card payments as a contractor, here are some other tips to keep in mind to get the most out of your payment processing system.

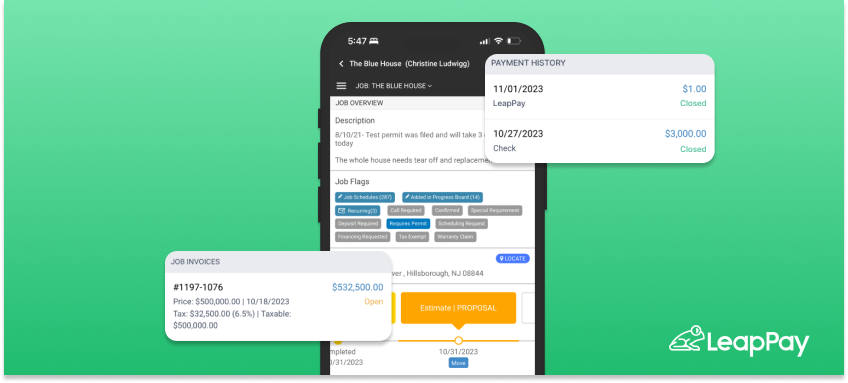

Integrate Payment Records into Your CRM

Avoid confusion and miscommunication from the office to the field by choosing a payment processing system that integrates into your CRM. When systems like LeapPay and Leap CRM talk to each other, you’ll always know when your customer has settled up their latest invoice, or if you need to give a lead a gentle nudge on completing a deposit.

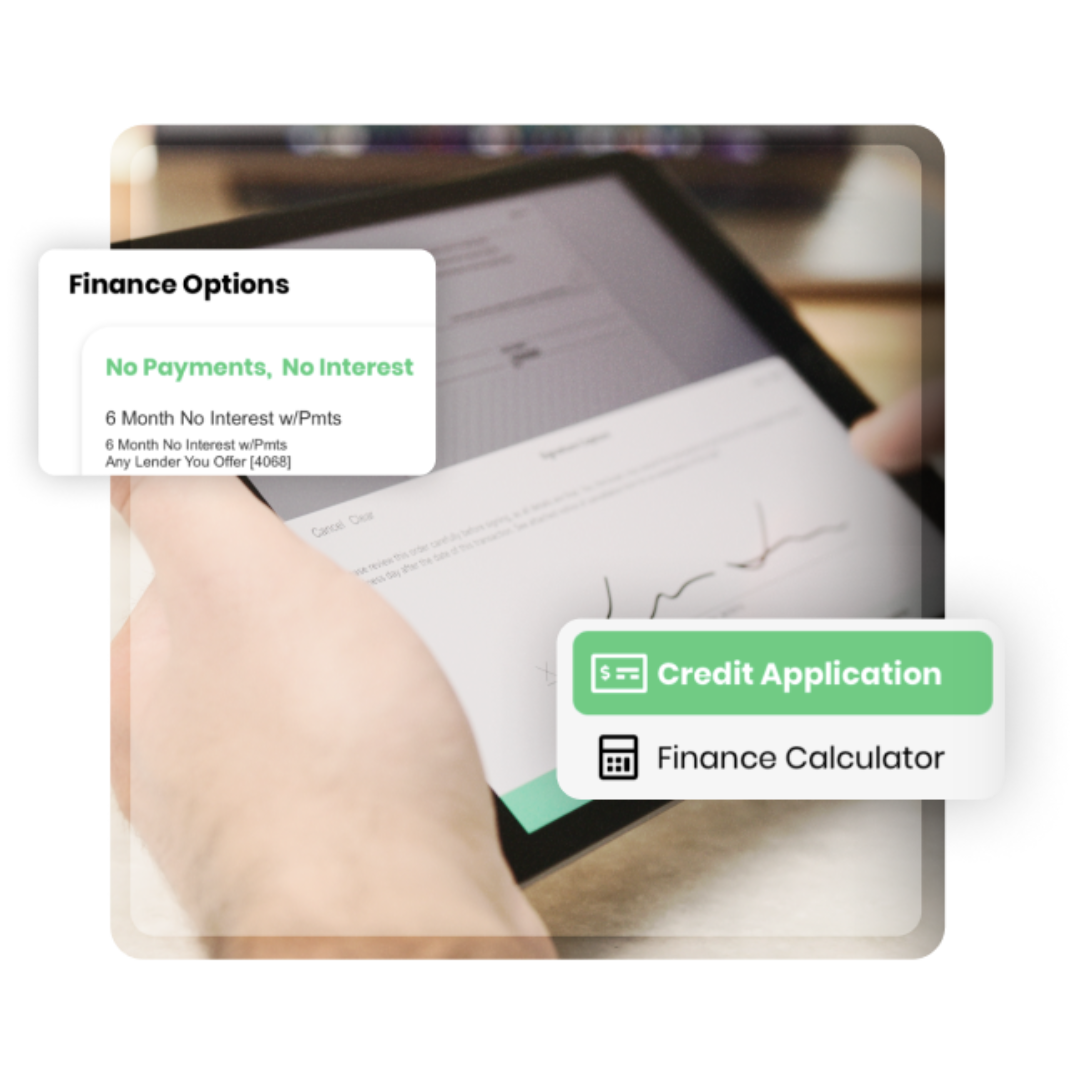

Offer Financing to Homeowners

Offering financing to homeowners as a contractor will give homeowners more options to finance their project and win you more jobs. Lending options can turn a no into a yes at the kitchen table and equip your sales team to offer affordable payment plans as part of their pitch.

Avoid Past Due Accounts

When you offer payment plans as a contractor, there’s always a chance that an account might fall past due. Make sure that you include payment terms on every invoice and resend the unpaid invoice with a friendly reminder or phone call at least once a week until it’s settled.

If this doesn’t work, you can then explore options like filing in Small Claims court after 90 days or turning the account over to collections.

However, equipping your team with an easy method to collect payments on the spot can help you avoid the runaround.

Make Payment Collection Easy with LeapPay

You’ve got a lot of jobs on your plate, and we’d bet that dealing with endless invoices, data and payment-chasing is one you’d love to take off. That’s why we created LeapPay, a payment management tool that wrangles your invoices, payment collections, and satisfies your customers with fast, secure options to pay for their home improvement projects. It’s the best way for homeowners to pay contractors, and incredibly easy to use!

Plus, LeapPay connects seamlessly to Leap CRM, allowing you to manage the customer experience without friction from start to finish. Interested in learning more? Schedule a demo to see Leap in action!