Roofing replacement is a necessary investment for homeowners. However, rising costs can be unsettling and often lead many Americans to delay the project or never commit in the first place. While some families can afford the work outright, most will require some form of financing to get started. So, should roofing companies offer financing to ease the minds of homeowners and close more deals?

It’s a question that has gained significant traction in recent years. And it has now evolved into a strategic certainty. Therefore, let’s look into the reasons why offering financing can empower roofing companies to sell more jobs while addressing one of the most significant concerns homeowners face – the cost of roofing projects.

Why Should Roofing Companies Offer Financing?

When homeowners consider investing in a new roof, they often confront a common dilemma: how to balance the essential need for a well-maintained roof with the financial implications of the project. Many roofing companies have recognized that by offering financing options, they can remove this obstacle and give homeowners the freedom to make decisions based on need and quality, rather than solely on immediate financial constraints.

For example, roofing companies that offer financing are a step ahead, gaining benefits such as:

- Establishing trust by addressing cost concerns

- Expanding customer base and tapping into new markets

- Gaining a competitive edge in the market

- Boosting sales and revenue through sheer volume of work

- Providing flexibility in times of need and economic uncertainty

One of the most compelling reasons to offer financing is the power of choice it provides homeowners. By presenting financing plans tailored to different budgets, roofing companies demonstrate empathy and flexibility. This builds a stronger rapport with potential customers. Moreover, it transforms the sales process from a mere transaction into a partnership that prioritizes the homeowner’s best interests.

Addressing Cost Concerns: The Elephant in the Room

It’s no secret that the cost of roofing projects can be a substantial financial commitment for homeowners. In fact, this financial apprehension often becomes a barrier to sealing the deal. Most homeowners are hesitant to take on a significant upfront cost.

Roofing companies that offer financing can effectively alleviate this concern by breaking down the total cost into manageable payments. By doing so, they position themselves as problem solvers, not roadblocks. Understanding and addressing the primary obstacle that homeowners face will make a world of difference in the sales experience.

Moreover, the fear of unexpected costs or hidden fees can create skepticism among homeowners. When roofing companies present financing options, they establish trust and transparency. Homeowners can make informed decisions with a clear understanding of the financial terms. This leads to a smoother sales process and a more satisfied customer base.

Expanding the Customer Base: Tapping into New Markets

One of the indirect benefits of offering financing is the potential to tap into new markets and demographics. In general, these are customers that may have previously been out of reach.

Not all homeowners have the same financial capabilities. And by offering financing, roofing companies open their doors to a broader spectrum of customers.

New homeowners may be eager to invest in home improvement but are constrained by limited upfront funds. By accommodating their financial circumstances, roofing companies can capture a segment of the market that is likely to grow in the coming years.

Competitive Edge: Rising Above the Competition

In a competitive roofing industry, differentiation is key. When two roofing companies offer similar services at similar price points, the decision often boils down to the finer details. Offering financing can be a differentiating factor that tilts the scales in favor of one company over another.

By prominently featuring financing options as part of their sales pitch, roofing companies stand out as forward-thinking and customer-centric. This not only attracts new customers, but also fosters customer loyalty.

When homeowners realize that a roofing company is invested in their satisfaction, both in terms of service quality and financial convenience, they are more likely to return for future exterior needs and recommend the company to friends and family. Furthermore, it can lead to upsells on the current project.

Boosting Sales and Revenue: A Win-Win Scenario

From a business standpoint, the decision to offer financing can yield substantial benefits for roofing companies. While some may worry about the potential cost, the truth is that these costs are often outweighed by the increase in sales and revenue.

When homeowners are presented with financing options, they become more inclined to proceed with the roofing project. Overall, this increases the volume of jobs secured by the roofing company. And the surge in business not only enhances revenue but also creates a positive cycle. As more jobs are completed, the company’s reputation grows and attracts more customers.

Navigating Economic Uncertainties: Flexibility in Challenging Times

Economic uncertainties, such as recessions or unexpected financial crises, can significantly impact the roofing industry. A homeowners’ ability to undertake large-scale projects like roof replacements is less likely. During these challenging times, offering financing becomes more than a strategy; it becomes a lifeline for both homeowners and roofing companies.

Financing provides homeowners with the means to address urgent roofing issues without straining their finances. For roofing companies, it ensures a steady stream of business even when external economic factors might otherwise slow down the industry. This adaptability to changing circumstances highlights the long-term viability of offering financing as an essential tool for roofers.

Offer Financing Options with Leap

The question of whether roofing companies should offer financing has evolved from a mere consideration to a fundamental strategic decision. By doing so, you empower homeowners with choice, address their most significant concern – cost – and stand out in a competitive market. The ability to provide financing options expands the customer base, cultivates trust, and ultimately boosts sales and revenue.

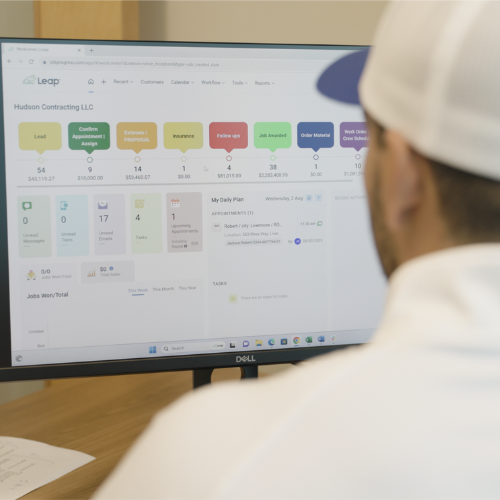

That’s why Leap is proud to provide roofing contractors with the industry’s leading point-of-sale software, SalesPro. With SalesPro, roofing companies can offer financing directly through the application. In fact, financing and credit checks are just one click away thanks to our partner integrations.

In addition, the SalesPro software gives your sales team the tools they need to close more jobs and widen your margins. From quick estimates to pricing control and digital contracts, SalesPro will help you provide a more professional sales experience that resonates with homeowners. You no longer have to dig through old product sheets and samples that can cost you time and kill a potential deal.

In an industry where differentiation and customer satisfaction are paramount, offering financing emerges as a powerful tool for roofing contractors. It not only benefits homeowners, but also enables roofing companies to secure more jobs, build a robust reputation, and navigate economic uncertainties.

To learn how Leap can help you provide financing in a professional manner, fill out the form below and schedule a demo with our SalesPro tool! As the roofing landscape continues to evolve, Leap has become a cornerstone of the sales process for roofing companies across the country.