As a contractor, dealing with payment processing can be one of the most frustrating aspects of running your business. Whether it’s waiting for checks to clear, managing multiple payment methods, or dealing with delayed payments, the traditional ways of handling payments often create more headaches than solutions. These pain points can disrupt your cash flow, waste valuable time, and ultimately slow down your business growth.

Avoid High Transaction Fees

Many payment processors charge high transaction fees. Unfortunately, this cuts into your margins and making jobs more expensive for your customers.

LeapPay offers some of the most competitive rates in the industry, often matching or beating those of leading competitors. This means you can retain more of your hard-earned money and offer more competitive pricing to your customers.

Eliminate Slow Payment Processing

Traditional payment methods often mean waiting weeks for checks to clear and chasing down late payments. This delay not only disrupts your cash flow but can also stall ongoing projects.

With LeapPay, payments are processed electronically and securely. Overall, this gives you quicker access to your funds and ensuring you’re paid promptly for your work.

Automate Data Entry

If you’re juggling multiple payment methods, chances are you’re also spending a lot of time on manual data entry. This process is time-consuming and prone to errors. Furthermore, it can lead to financial discrepancies and additional administrative work.

LeapPay automates the payment process, syncing with your invoices and reducing the risk of mistakes. In addition, it helps to free up your time to focus on more critical business activities.

Offer Multiple Payment Options

In today’s digital age, customers expect a range of payment options. If your current system only allows for traditional methods, you might be losing out on potential customers who prefer to pay with credit cards, debit cards, or ACH transfers.

LeapPay gives you the flexibility to offer multiple payment options. In general, this can improve customer satisfaction and potentially increasing your conversion rates.

Improve Cash Flow Management

Delayed payments can have a ripple effect on your business. For instance, it can make it difficult to manage ongoing expenses or invest in new projects.

LeapPay speeds up the payment process, helping you maintain a steady cash flow. With quicker access to your funds, you can keep your projects on schedule and ensure your business remains financially stable.

Managing the Payment Lifecycle

From initial deposits to milestone payments, managing the payment lifecycle of a project can be complex. Therefore, it’s crucial to receive payments at each stage to keep the project moving forward.

LeapPay streamlines this process, ensuring that you get paid on time. This helps you maintain financial stability throughout the project.

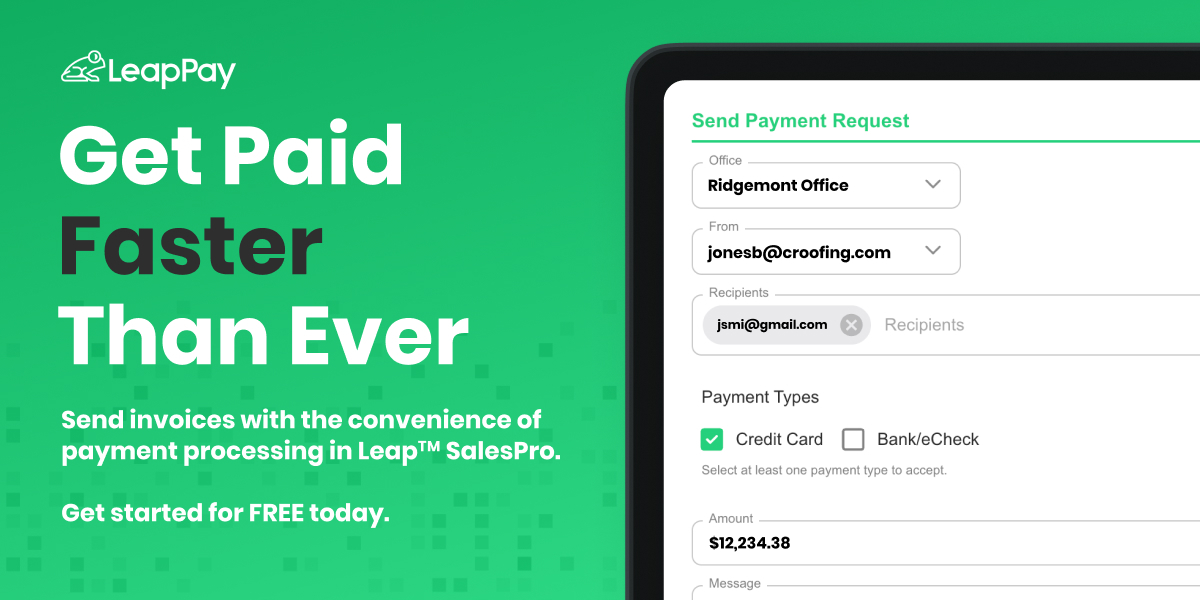

Why LeapPay?

LeapPay is designed to address these common pain points by integrating directly with Leap SalesPro. This seamless integration means you can manage everything from invoicing to payment processing within one platform. Additionally, LeapPay prioritizes security with a PCI-compliant system, ensuring that all transactions are protected.

If you’re tired of dealing with the hassles of traditional payment processing, LeapPay could be the solution you’ve been looking for.

Use LeapPay on LeapCRM and Leap SalesPro to help you streamline your payment processes, improve cash flow, and ultimately grow your business.