Many contractors hesitate to offer financing and digital payment tools for a variety of reasons, whether it’s concerns about complexity, security, or simply not knowing how it fits into their business. With Leap’s tools, including financing within SalesPro and Leap Pay for payments, we make it simple. In this article, we’ll address some common reasons contractors might avoid these tools and explain how Leap makes it easy to offer financing, streamline payments, and grow your business.

Financing: Close More Deals and Increase Job Size

1. “I go straight to the lender. What’s the benefit of doing it through SalesPro?”

SalesPro is one of the only in-home sales tools with a Universal Credit Application that allows you to submit a single loan application to multiple lenders. This saves you time, reduces errors, and increases your approval rates. Plus, with all your lending applications in one place, you can track and manage loans more efficiently without needing to switch between lenders.

2. “My lender isn’t integrated into SalesPro. Why were these lenders selected?”

No worries! If your lender isn’t in the network, we can possibly work on getting them integrated into SalesPro. In the meantime, we’ve negotiated rate cards with top lenders offering great rates across all credit types, giving you better dealer fees and homeowners more loan options.

3. “I don’t need financing, most of my customers pay upfront.”

Offering financing opens new opportunities for larger projects and higher-value clients, helping you close more deals by making it easier for homeowners to afford bigger projects. Contractors who offer financing see an 18% increase in close rates and a 30% boost in job size.

4. “Financing feels too complicated to explain to my customers.”

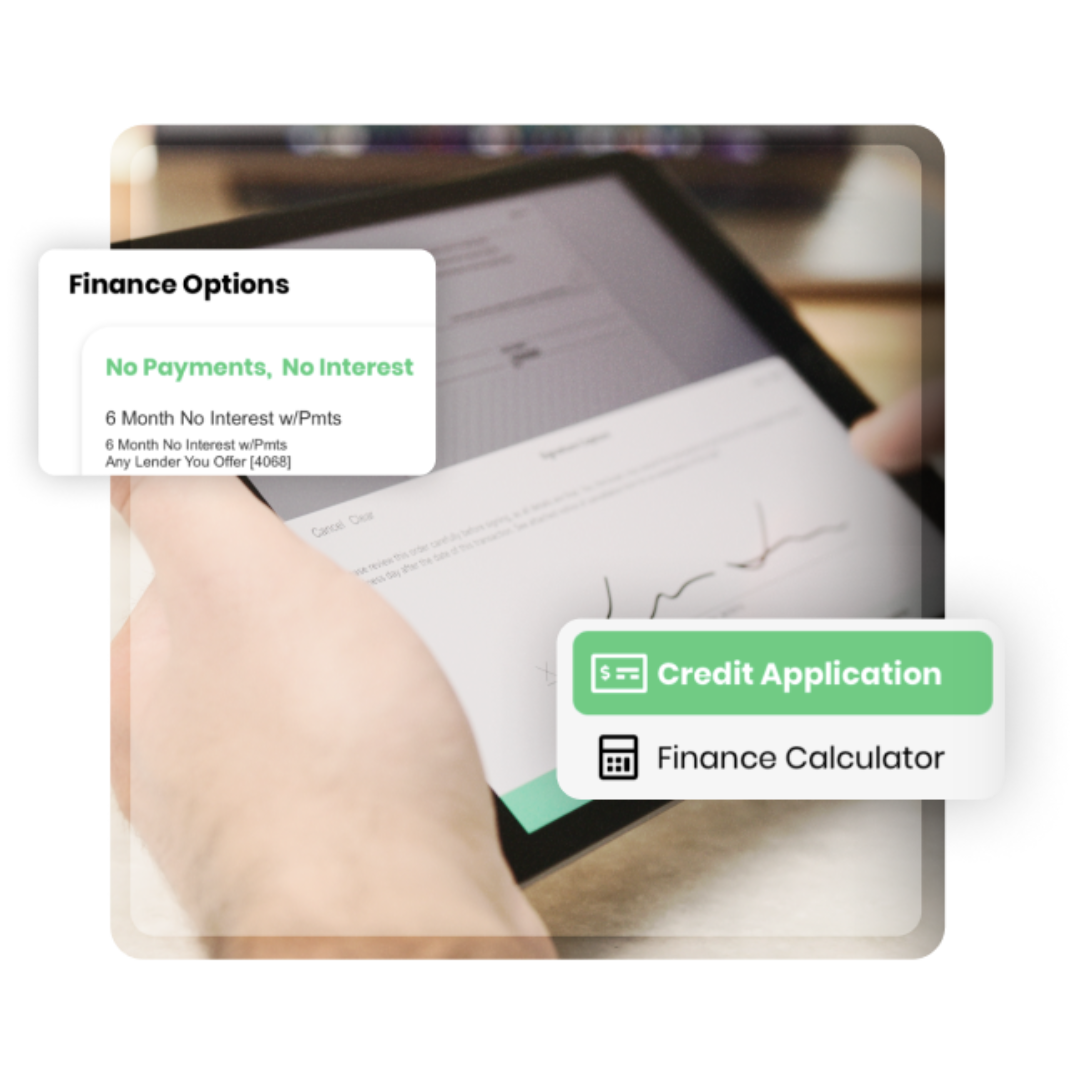

We make it easy with a built-in Finance Calculator that clearly shows different financing options. Integrated directly into SalesPro, you can select and explain plans right during your sales pitch and even submit the application on the spot. It’s seamless and simple for both you and your customers.

5. “I don’t want my customers’ credit to be impacted by multiple checks.”

With lending on SalesPro, many lenders offer soft credit checks for pre-approval, so your customers can explore financing options without affecting their credit score.

6. “I already offer financing through a different platform.”

With lending on SalesPro, you can consolidate everything into one platform, from application submission to tracking. No need for a separate tool, financing is fully integrated into the tool you already use! You’ll also get access to multiple lenders with competitive rates, plus valuable data insights to optimize your offerings. All this, without switching between platforms.

Leap Pay: Simplifying How You Take Payments

1. “Transaction fees are too high.”

Leap Pay offers some of the lowest transaction fees in the industry (and it’s free, included in your subscription!). Plus, the time saved through integrating payments into the tool you already use and reduced manual tasks makes the overall ROI far outweigh any fees. Faster payments mean improved cash flow and the ability to take on more jobs, ultimately boosting your bottom line.

2. “Is it secure?”

Leap Pay is fully PCI DSS compliant, meaning every transaction is handled with top-notch security. We also maintain SOC 2 compliance to guarantee data privacy and protection. Sensitive payment data is encrypted during all transactions, safeguarding both you and your customers from fraud or breaches.

3. “Will this integrate with SalesPro/Leap CRM?”

Absolutely! Leap Pay is fully integrated into both SalesPro and Leap CRM, so there’s no need for additional software or manual entry. Everything is connected and fully automated, fitting seamlessly into your existing workflow without disruption.

4. “Switching systems seems too complicated.”

Transitioning to Leap Pay is a breeze. It’s built directly into SalesPro and Leap CRM, so onboarding is quick and easy, just a few minutes of setup, and you’re good to go. You won’t have to juggle multiple platforms or worry about a steep learning curve. You can also reach out to our team who will help you get onboarded and trained every step of the way!

5. “We mostly accept check or cash.”

Traditional payment methods like checks and cash can be time consuming, often leading to delays in receiving funds and the hassle of manually tracking payments. Waiting for checks to clear can disrupt cash flow and require additional administrative work to reconcile accounts. Leap Pay streamlines this process by enabling customers to make immediate payments via a credit card or ACH, ensuring faster access to funds, and reducing the need for manual payment tracking. Moreover, offering digital payment options aligns with modern homeowner expectations, enhancing customer satisfaction and keeping your business competitive in a rapidly evolving market.

Streamline Financing and Payments with Leap

Providing financing and digital payments doesn’t have to be complicated. Leap SalesPro is one of the only in-home sales tools to leverage a Universal Credit Application where you can submit an application to multiple lenders, making it easy to offer multiple financing options and get quick approvals directly within the tool – no separate platform needed. Plus, Leap Pay makes processing and tracking payments faster and more secure, to keep your business running smoothly and securely.